Compliant Open Source Consumption

Using open source within regulated organisations must be done in accordance with the policies and procedures in place to control risks and adhere to regulation. In this article we will look at:

- The three lines of defence model.

- The purpose of the compliance department.

- Understanding the risk and control framework within regulated organisations.

- Which policies and laws affect open source consumption.

- How the open source consumption policy works in a typical regulated organisation.

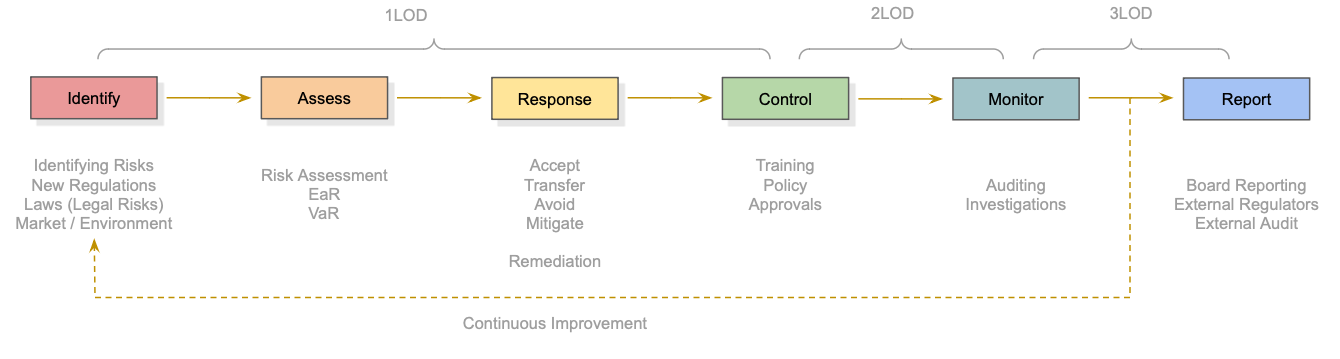

Three Lines of Defence (3LOD) Model

The three lines of defence is a risk management model commonly used in the banking industry to establish an effective and efficient risk management framework. The three lines are:

1LOD: Risk Owners. This line of defence consists of the business units or front-line operations responsible for managing risks on a day-to-day basis. This includes the employees who execute operational tasks and processes, such as loan officers or traders.

2LOD: Oversight This line of defence consists of risk management functions that are responsible for providing oversight and guidance to the first line of defence. This includes the risk management and compliance functions. The second line of defence monitors the effectiveness of the first line's risk management activities and provides guidance and support as needed. This includes periodic reviews, audits, or use of automated tools to monitor risk and control activities.

3LOD: Independent Assurance: This includes internal auditors . The third line of defence provides independent assurance on the effectiveness of the overall risk management framework and ensures that any deficiencies or gaps are addressed. This includes periodic audits, required disclosures and annual financial reporting.

Within regulated industries, the 3LODrisk also reports upwards to:

- External auditors/regulators: External auditors can play an important role through their considerations of the governance and control structure where this is relevant to financial reporting. For regulated entities, governance and risk management requirements (see below for examples) are often set by regulators.

Further Reading:

The Compliance Function

The compliance department in a bank is responsible for ensuring that the bank operates in compliance with laws and regulations. This includes developing and implementing policies and procedures to manage compliance risks, conducting risk assessments, providing training and education to employees, monitoring the bank's compliance with laws and regulations, and reporting any non-compliance to senior management and the board of directors.

The compliance department plays a critical role in maintaining the bank's reputation and avoiding financial and legal penalties that may result from non-compliance.

Risk And Control: A Case-Study

All organisations should have some framework for controlling for risks. However, in regulated industries this framework is a significant part of the whole organisation, with multiple departments (e.g. Risk, Compliance, Internal Audit) participating in control processes.

In this section we are going to present a generic Risk and Control Framework and apply this to the example of Log4Shell, a recent security vulnerability, to see how organisations might respond to new risks and incorporate them into their processes.

The above diagram breaks down the process of risk and control and is a simplification (for explanatory purposes) of various pre-existing frameworks that an organisation could use, all incorporating the idea of feedback.

For further details, see:

- COSO's Enterprise Risk Management Framework

- NIST's Cybersecurity Framework

- RMF

- Deming's Plan Do Check Adjust

- 8-Step Process for Facility Security Risk Assessment

In 2021, the Log4Shell incident occurred which forced many organisations to re-assess their stance towards open source consumption.

1.Identify

The Log4Shell vulnerability was reported in November 2021 and received significant media attention:

Log4Shell (CVE-2021-44228) was a zero-day vulnerability in Log4j, a popular Java logging framework, involving arbitrary code execution. The vulnerability had existed unnoticed since 2013 and was privately disclosed to the Apache Software Foundation, of which Log4j is a project, by Chen Zhaojun of Alibaba Cloud's security team on 24 November 2021. - Log4Shell, Wikipedia

2. Assess

CVE-2021-44228 assigned the CVSS score (10) which meant that the issue was widespread, easy to exploit and could have severe consequences. For some organisations (including governments) the attention around this vulnerability led to a realisation that open source supply chains were a new type of risk that would need closer attention.

From a compliance perspective, this vulnerability posed a significant Data Leakage Risk, which potentially violates several laws.

3. Response / Remediation

- For firms, an immediate effort was required to patch all Java systems using affected versions of Log4j that were facing the public internet.

- For unprepared organisations, a new focus on open source Supply Chain Security.

4. Control

An good template for software consumption controls is the NIST Cybersecurity Framework (NIST CSF):

NIST Cybersecurity Framework is a set of guidelines for mitigating organizational cybersecurity risks, published by the US National Institute of Standards and Technology (NIST) based on existing standards, guidelines, and practices. The framework "provides a high level taxonomy of cybersecurity outcomes and a methodology to assess and manage those outcomes" - NIST Cybersecurity Framework, Wikipedia

A firm would need to adopt a model like this into its security organisation which would codify how to deal with situations like Log4Shell. This might help in the following ways:

- Identifying affected software: Rather than having to check every system to see if it is vulnerable, a Software Inventory would have given exact details of which systems were affected. (See also SBOMs.)

- Detection processes: Could be used to determine whether attacks are taking place.

- Response: the organisation would have a process in place for dealing with the vulnerability (applying patches, communicating with stakeholders, implementing workarounds etc.)

These new controls will be described within Policy Documents that the compliance department will help to write. Setting up controls like these might involve significant training of staff.

Example Control: Approval Process for Using A New Software Library

Organisations might introduce an approval process for the use of new software libraries. When a new (to the firm) library is required a request would be submitted and require review from Legal (for licensing checks), CIO (for considering data implications), CISO/Security teams (for security considerations).

Consideration might be given to the venue in which the software is running. Internal Cloud will have different licensing requirements to external cloud. Hybrid cloud environments might require stricter rules around data security.

Example Control: Security Training

At this point, the organisation might consider Training around security topics for open source.

5. Monitor

Evidencing refers to the process of collecting, maintaining, and presenting documentation, records, or other forms of proof that demonstrate an organization's adherence to applicable laws, regulations, and industry standards.

Evidencing is a crucial aspect of compliance management, as it enables organizations to show that they are fulfilling their compliance obligations, both internally and externally.

Within the Log4Shell case study, the internal auditors might require a quarterly report detailing who is dealing with vulnerabilities, evidence of identification, assessment and control. Can the security function demonstrate that they have managed the risk effectively?

For the above controls mentioned above, it might require evidencing of mandatory training or a log of activity in the approval process

6. Report

The board, external auditors and regulators will want to know that the firm is complying with its duty to the shareholders, financial standards and laws respectively.

For a high-severity incident like Log4Shell, reporting is likely to begin early with the 1LOD and 2LOD detailing their plans for remediation to the board, with follow-ups as the incident unfolds. Regulators might also request oversight into the remediation activities.

7. Feedback / Continuous Improvement

As the Data Leakage article shows, there are significant existing laws around data leakage which would cover the situation where the Log4Shell vulnerability was exploited and data was leaked.

Nevertheless, as a result of Log4Shell (and other high-profile incidents), governments have been under increased pressure to draft new laws around cybersecurity. As these become law, they will re-enter the risk-and-control framework and organisations will need to update their controls and policies to meet them.

See Also:

Intersection with Open Source Consumption

The case study above shows how the realisation of a new threat (Log4Shell) can lead to the creation of new policy within an organisation to manage the risk.

So, we can see that compliance policy exists to deal with risk. There are several banking compliance policies that intersect with the use of software generally within an organization, which apply equally to open source software:

Data Leakage Risk

Legal Risks

- Accountancy regulations.

- Laws around electronic communication in financial markets.

- Cross-border obligations.

- Anti-Money Laundering (AML).

- Intellectual Property and Licensing Policies.

- Sanctions.

- Counter-Terrorism Laws.

Operational Risk

Dependency Risk

Reputational Risk

Consumption Controls

The consumption policy for open source will usually be arranged around meeting controls for the above risks.

CI/CD Pipelines

The security team may mandate the use of certain checks within the CI/CD pipeline for checking for vulnerabilities. tbd

See Also:

Further Reading

- Compliant Financial Infrastructure. A project that exists to accelerate the development, deployment and adoption of services provided for infrastructure in a way that meets common regulatory and internal security controls.

- SBOMs. Software Bill of Materials.